canadian tax strategies for high income earners

Maximize RRSPs Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie. Taxinvestment strategies for high-income Canadians.

Tax Planning Strategies For High Income Canadians

Loaning funds at the prescribed rate of interest to a spouse 1.

. This is done through shady accounting practices or stashing money in offshore accounts in tax-havens like the Caribbean. Discover several strategies that make for a tax-smart wealth plan. This has to generally be done within annual gift exclusions or loans.

50 Best Ways to Reduce Taxes for High Income Earners. Fortunately thoughtful tax planning can help you your business andor your family keep more of what you have worked so hard to accumulate. My RRSP is maxed-out every year and unused contribution room within my TFSA will be gone by years end.

Using these accounts in the right. Canadian dividends are always taxed at lower rates than capital gains. But given that the Canada Revenue Agencys prescribed rate for loans of this nature is 1 per cent the impact should.

Max Out Your Retirement Contributions. Keep reading to find out five effective tips that you should be utilizing right now. Therefor interest income is not the most tax-friendly investment.

With interest income youre taxed at your marginal tax rate. Lets start with retirement accounts. Canadian Tax Tricks There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal.

Income-splitting and prescribed rate loans While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there are benefits for the average Canadian too. Heres how it works. Having the higher income earner pay family expenses.

Using the benefits of a registered education savings plan RESP or registered disability savings plan RDSP Investing child tax benefit money in the childs name. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount. A great example of a safe tax-avoidance strategy is the RRSP Registered Retirement Savings Plans.

Still the AMT has investment implications for some high earners. If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. Making a gift to an adult family member.

Income splitting and trusts. Tax minimization strategies for individuals Income splitting with family members Family income splitting is a fundamental tax planning strategy but many Canadians are not taking advantage of simple income. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Tax planning strategies for high-income earners. 9 Ways for High Earners to Reduce Taxable Income 2022 1. RRSP limit for the year.

Every Canadian has access to a few different tax-sheltered accounts to help them legally minimize their taxes. In this article we highlight 3 tax saving strategies that can be used without sacrificing the ability to build wealth. In all honesty taking advantage of a donor-advised fund is probably one of the best strategies to reduce taxes for high income earners because it allows you to take current and future year contributions and deduct them all in the current year.

Registered Retirement Savings Plans RRSPs Registered Education Savings Plans RESPs and Tax-Free Savings Accounts TFSAs. This can be seen by comparing the 2005 pre-tax low-income cut-off rate of 153 with the after-tax rate of only 108. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

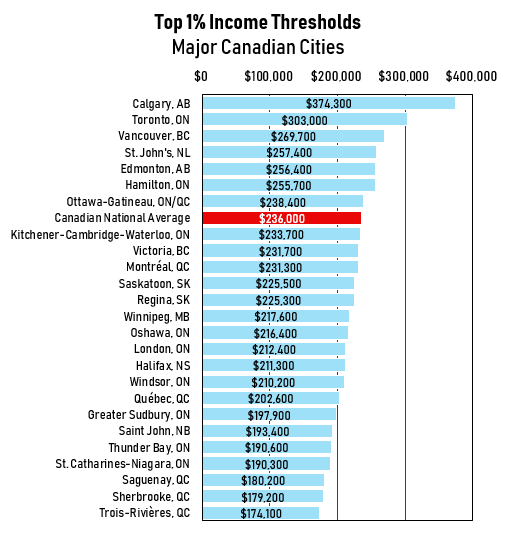

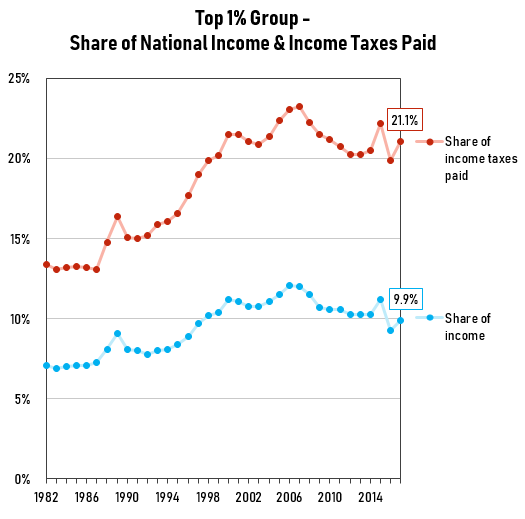

Campbell adds that higher-earning spouses have to declare the interest earnings. Im in the top 1 of income earners in Canada and much of my income this year will be taxed at the top nominal rate for Ontarians 5353. Each plan defers or mitigates tax obligations in different ways.

Are you a Canadian looking for strategic ways to save money on your income tax. Lend to a Family Trust to Split Income. Sell Inherited Real Estate.

Canadian dividends are a tax efficient source of investment income because they qualify for a special dividend tax credit which keeps the tax burden low. The Canadian income tax system is highly progressive. Tax-sheltered accounts are extremely useful because they help you delay reduce or even avoid paying taxes all together.

If one spouse is in a higher tax bracket than another they may want to shift some of that taxable income to another family member including children. The contribution you will make will come straight out of your. For high income earners Please contact us for more information about the topics discussed in this article.

Contributions to an RRSP lower your taxable income. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. A 125 headline rate for trading income or active businesses income in the Irish tax code.

This is one of the most important tax strategies for you as a high-income earner. The government is not against helping tax payers minimize their tax bills legally. Employer-based accounts such as 401 k and 403 b accounts allow you.

High Income Earners Need Specialized Advice Investment Executive

How To Reduce Taxes For High Income Earners In Canada

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Everyday Tax Strategies For Canadians Td Wealth

How Can I Reduce My Taxes In Canada

Tax Planning For High Income Canadians

How To Pay Less Tax In Canada 12 Little Known Tips

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax